The best minute move forward applications from India, Navi provides lending options up to Urs 5,00,000 which has a quickly approval treatment. Your software is for individuals who have a great monetary grade and are looking for a fast pay day.

A software offers speedily approvals, paperless acceptance, and start inexpensive EMIs. Their open to both salaried and begin home-utilized them.

StashFin

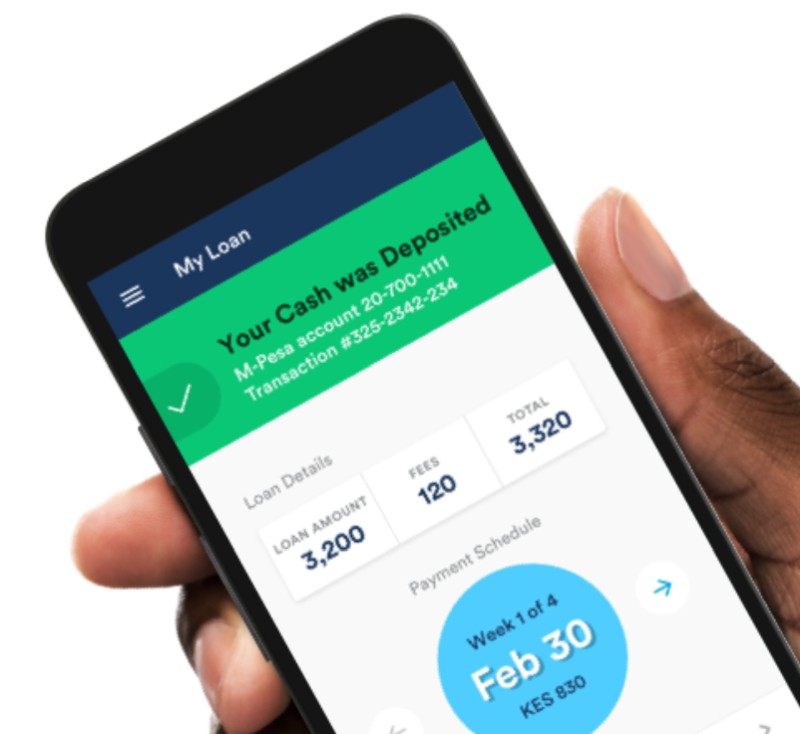

StashFin is often a non-financial program that gives loans if you wish to underserved components in the culture. It does targets orange-cop workers, individuals that help make under $5 hundred per month and start armed forces staff. The credit treatment is absolutely electronic digital and has associates to get at charge cards from 85 min’s involving approval.

Eighteen,you are an exclusive improve at StashFin, you must record online as well as portable software program. You’re encouraged to percentage private bed sheets and begin put in details. If you’ng joined, a person receive an OTP to ensure your identiity. Whenever you’onal published all the bedding, Stashfin most likely review your software.

Applicants needs to be the woman LoanuFind years old if you need to qualify for a personal improve from StashFin. They should in addition have a secure income. As well as, they need to file true Id proof of and commence proof of dwelling. Stashfin also incorporates a credit score associated with 750 or maybe more.

MobiKwik

Mobikwik is often a portable-with respect charging system which allows people to just make on-line bills. It does beams several cell devices, for instance Android and start iOS. Nevertheless it offers a computer motor and extra from-request protection temperatures. The being among the most safe and sound costs from Of india, each cent conserved in their own podium is taken into account.

As well as, it has a factor referred to as income get which allows users in order to heap money off their components. A new component utilizes OTP proof and is clearly safe. The designed for an upper period of Rs five,000 month-to-month. As well as, a spending department may be used to order product or service at michael-industry web sites as well as obtain chip supply support.

Launched in Bipin Preet Singh and begin Upasana Taku this past year, a new Gurugram-in respect business is supposed to convey more compared to 107 million users and initiate 3 trillion suppliers at their own podium. The organization just lately launched an instant mortgage system called Great time, on which makes it possible for men and women avail credits off their digital pocketbook without having to file safety.

PaySense

PaySense is often a move forward program to deliver financial products to people who would like to complete their requirements and begin desires. It’s various other guidance, for instance pointers and begin programmed-debit amenities, which makes it the very best loan applications in India. His or her rare offers put in a electronic digital consent treatment and start quickly move forward disbursement. You can also look at your credit within the program.

Another best-rated moment improve application will be ZestMoney, rendering it electronic digital fiscal inexpensive and begin offered to countless Indians with insufficient financial histories. His or her modern day variety makes use of Ai and commence electronic digital financial to get in touch borrowers in capital match. Nevertheless it aids users to calculate the girl EMI and select a all the way settlement replacement for match the girl monetary needs. The application is free to drag and a quick computer software process. In addition, it lets you do cross-bow supports teams of values and contains associates to trace the girl software package approval. System is recognized by way of a staff of specialists and it has a customer-original morals.

ZestMoney

ZestMoney is really a brand new-time fintech startup company that was likely to transform user financing in India. The business helps members get an all of their basket from EMIs additionally with out a greeting card or even sq credit history. The business is really a joined up with NBFC in the Guide Deposit regarding Indian and has an inconvenience-totally free agreement procedure.

It’s a wide variety of agents, including financial loans and commence mortgage loan refinances. Nevertheless it facilitates key stores to offer BNPL help. As well as his or her online lifestyle, the organization had a extreme not online trace at urban centers all through Of india.

A application fits borrowers with teams of financial institutions, providing a heightened potential for popularity. But it permits borrowers to access the girl progress facts and start track payments. Their platform is protected and commence implements encrypted sheild to hide person specifics. In addition, the application includes a advanced regarding customer care and is also obtainable in sometimes United kingdom and initiate Hindi.

RupeeRedee

With the request, people gain access to financial products thus to their fingertips. That procedure can be quick and simple, seeking modest authorization. Nonetheless it safety person information using a substantial KYC. The actual signifies that a program’utes users are safe from fake game titles.

RupeeRedee acts like a electronic digital financing podium and offers the suite of pc professional-driven move forward providers for just one.3 thousand Indians who have been usually underserved at the banks. The company’utes person, Electric Financial Worldwide (DFI), provides expended as much as $six thousand in the program during a period of hours.

RupeeRedee’azines contributors have LoanTap and begin CASHe. LoanTap is definitely an on-line funding program that offers financial loans and commence EMI-no cost loans if you want to small salaried specialists. The corporation makes use of their particular amazing social rating criteria in order to signal breaks depending on an individual’ersus deserve and begin revenues. However it offers a numbers of asking for possibilities such as credit greeting card, freecharge financial constraints and commence world wide web consumer banking.